Leave a legacy:

Stock & Appreciated Assets

Discover how to maximize your gift and create a legacy.

Gift Your Stock & Appreciated Assets

Over the past five years, Barrow Neurological Foundation has received more than $8 million in stock gifts from generous donors. These gifts have contributed to the creation of renowned centers dedicated to providing world-class care, chairs that recognize exceptional physicians and scientists, innovative research that saves lives, and art that promotes healing.

If you have been making cash contributions to Barrow Neurological Foundation, you could receive additional tax benefits by gifting stock, bonds, equities, and other assets. If you transfer stock to Barrow Neurological Foundation, we will be able to sell the stock tax free, allowing you to avoid any capital gains tax you would otherwise have to pay. Plus, you can get a full-market value tax deduction on the gift. If you really like the stock, you can buy it back on the same day with the cash you planned to donate and reset the basis.

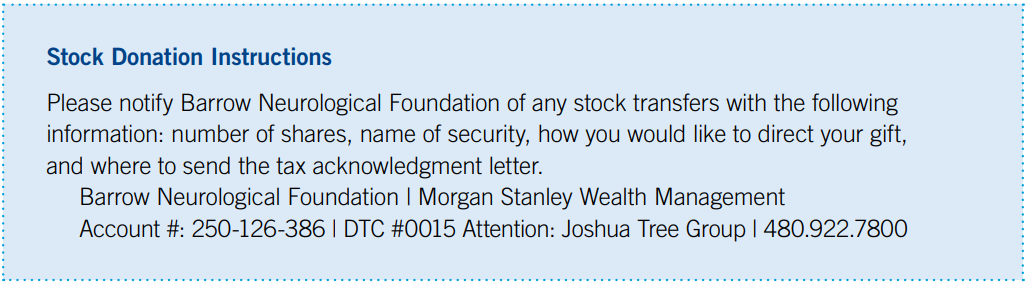

Stock Donation Instructions

Please notify Barrow Neurological Foundation of any stock transfers with the following information: number of shares, name of security, how you would like to direct your gift, and where to send the tax acknowledgment letter.

Barrow Neurological Foundation | Morgan Stanley Wealth Management .

Account #: 250-126-386 | DTC #0015 Attention: Joshua Tree Group | 480.922.7800

Learn more about maximizing your gift!

Emily Lawson, Senior Director of Philanthropy

[email protected] | 602.406.1051

Discover More Programs

At Barrow Neurological Foundation, your donation is crucial in supporting three key areas: advanced patient care, curative research, and education for the next generation of neuroscientists. Learn more about how your donation impacts each of the areas we treat.

As you think about your estate planning, consider leaving a legacy gift to Barrow Neurological Foundation in your will or trust to make a meaningful impact for years to come.

Retirement accounts often are the best assets to donate to charitable organizations, such as Barrow Neurological Foundation, during your lifetime and in your legacy.

A donor advised fund (DAF) is a “charitable savings account” that allows you to receive a deduction the year you need it most and give to charities and causes that are meaningful to you over time.

Create an income for life and a legacy that supports research, patient care, and education at Barrow.

There are many ways to gift life insurance and investment annuities.

Appreciated assets, including real estate, rental property, vacation homes, business assets, and business interests, are great ways to give to Barrow Neurological Foundation.

If you transfer stock to Barrow Neurological Foundation, we will be able to sell the stock tax free, allowing you to avoid any capital gains tax you would otherwise have to pay.

The information provided is not intended as legal or tax advice. For such advice, please consult an attorney, financial or tax advisor.